Chart Book (6th edition): Industry Summary – Private Residential and Nonresidential Construction

6. Private Residential and Nonresidential Construction

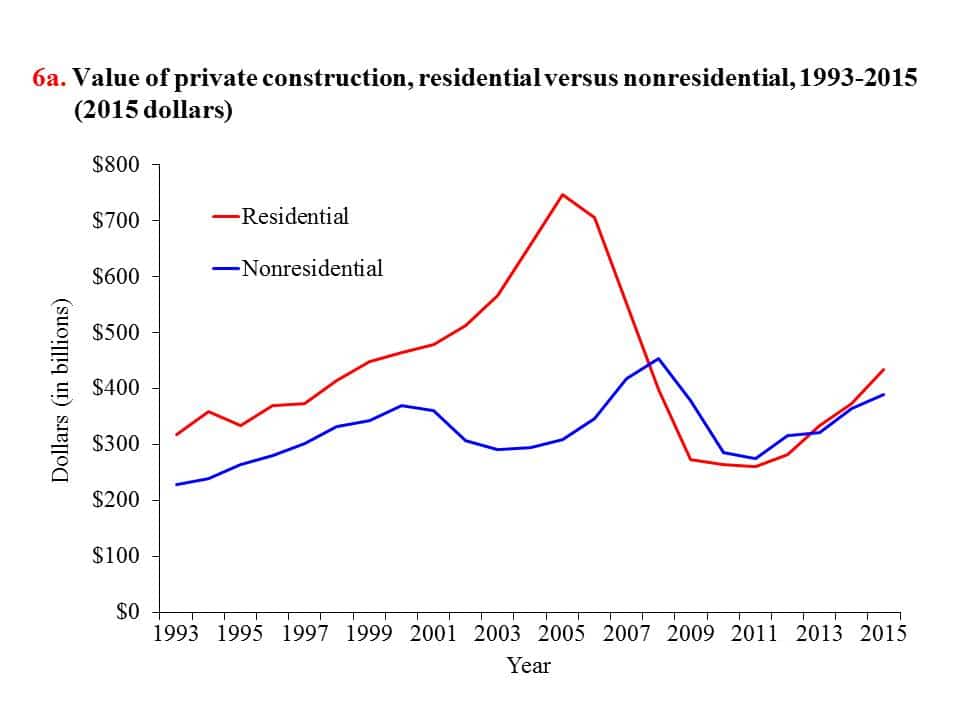

Private spending on construction dramatically dropped during the recent recession and recovered afterwards; this trend was especially pronounced in residential construction (see page 5). By 2015, private residential spending was at $433.7 billion, 65% higher than the $263.0 billion spent in 2010, after adjusting for inflation. Despite the rebound, spending is still 42% lower than its peak of $746.9 billion in 2005 (chart 6a).1 Compared to residential construction, the value of private nonresidential construction fluctuated moderately, reaching $453.8 billion in 2008, falling to $274.5 billion in 2011, and then recovering to $389.9 billion by 2015; 14% less than its value in 2008.

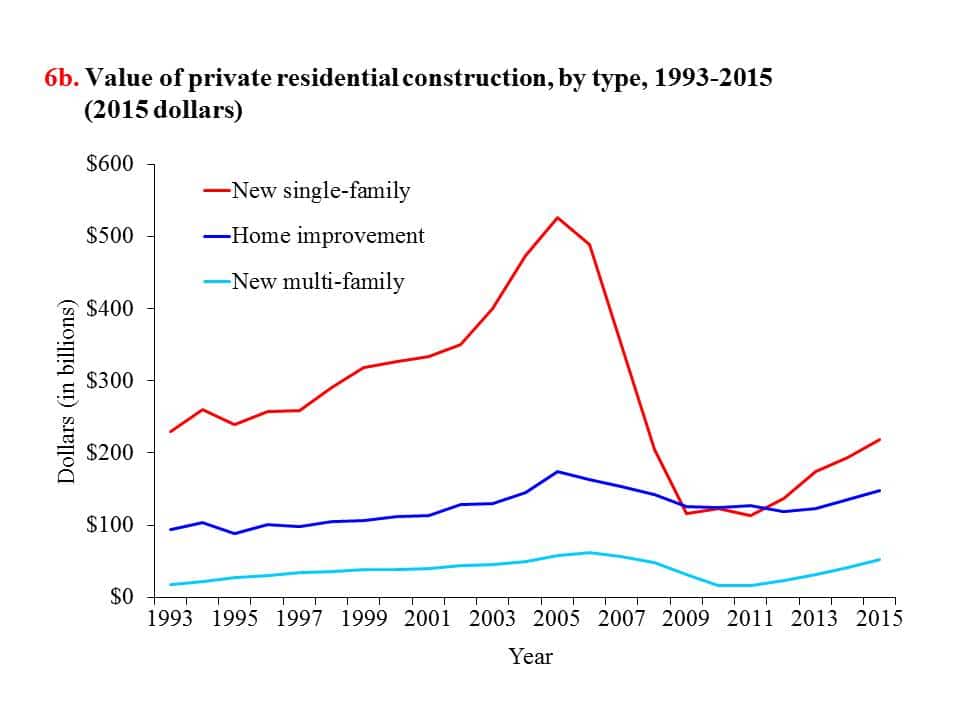

Spending on new single-family housing nearly doubled from 2009 to 2015 after adjusting for inflation, but remained about 58% lower than its 2005 level (chart 6b). Spending on private multi-family housing and home improvements both showed strong signs of recovery, reaching pre-recession levels by 2015.2

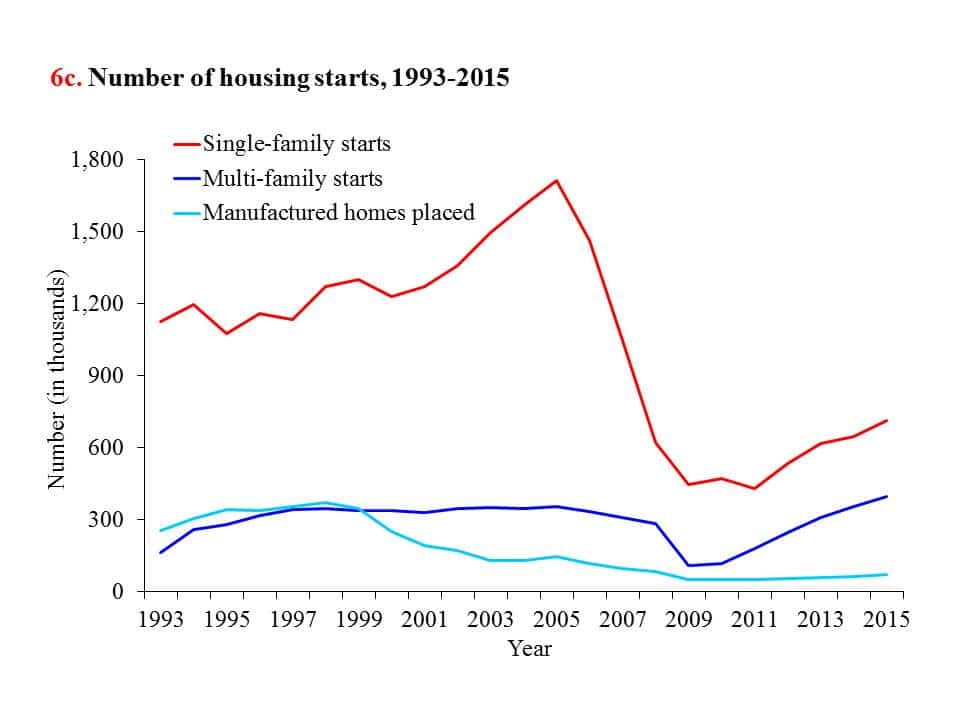

The New Residential Construction series measures new privately-owned residential construction activity by the number of building permits authorized, housing units started, and housing units completed.3 Corresponding to the pattern in residential construction value, the number of new privately-owned single-family housing unit starts reached 715,000 by 2015, 66% higher than the 431,000 units started in 2011, but only about 42% of the 1.72 million housing projects started in 2005 (chart 6c). New privately-owned multi-family housing unit starts, while declining during the recession, surpassed the 2005 level by 2015. Overall, total starts gradually recovered after the recent market crash,3 with the exception of manufactured home shipments, which dropped continuously from 1998 through 2010, ending with an 81% decrease by 2015. The number of single- and multi-family building permits authorized followed a similar trajectory as starts.4

Housing market trends affect jobs not only in the Residential Building Construction sector (NAICS 2361), but also in the Specialty Trade Contractors sector (NAICS 238). Typically, a large amount of work in residential construction is subcontracted to contractors in specialty trades. For example, 66% of the value of construction work done by framing contractors (NAICS 23813) in 2012 was related to residential construction (chart 6d).

(Click on the image to enlarge or download PowerPoint or PDF versions below.)

1. All the numbers are in constant dollar value, which means that the dollars are adjusted for inflation.

2. U.S. Census Bureau. Construction Spending: Definitions of Construction. http://www.census.gov/construction/c30/definitions.html (Accessed January 2017). Residential construction includes new single-family (new houses and town houses), new multi-family (new apartments and condominiums), and home improvements (such as remodeling, additions, and major replacements).

3. U.S. Census Bureau. New Residential Construction. http://www.census.gov/construction/nrc/ (Accessed January 2017). The New Residential Construction series compiles data on new privately-owned residential housing units authorized, started, and completed. This data source provides the number of: 1) new housing units authorized by building permits, 2) housing units authorized to be built, but not yet started, 3) housing units started (defined as excavation for the footings or foundation), 4) housing units under construction, and 5) housing units completed.

4. Joint Center for Housing Studies of Harvard University. The State of the Nation’s Housing 2016. http://www.jchs.harvard.edu/sites/jchs.harvard.edu/files/jchs_2016_state_of_the_nations_housing_lowres.pdf (Accessed June 2016).

Note:

Chart 6a – The Gross Domestic Product Implicit Price Deflator was used to adjust current dollar value to 2015 dollars.

Chart 6b – Private sector residential construction totaled $433.7 billion in 2015 (not seasonally adjusted). Year-to-year comparisons are adjusted in 2015 dollars.

Chart 6c – Total of 1.183 million housing unit starts in 2015; data cover the private sector only.

Source:

Chart 6a – U.S. Census Bureau. Historical Annual Value of Construction Put in Place series. http://www.census.gov/construction/c30/historical_data.html and http://www.census.gov/construction/c30/pdf/totalha.pdf (Accessed January 2017).

U.S. Bureau of Economic Analysis, Gross Domestic Product: Implicit Price Deflator [GDPDEF], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GDPDEF (Accessed February 2017).

Charts 6b and 6c – Joint Center for Housing Studies of Harvard University. The State of the Nation’s Housing 2016, Table A-1 – Housing Market Indicators: 1980–2015. http://www.jchs.harvard.edu/sites/jchs.harvard.edu/files/jchs_2016_state_of_the_nations_housing_lowres.pdf (Accessed June 2016).

Chart 6d – U.S. Census Bureau. 2012 Economic Census. Construction Industry Series. Value of Construction Work for Type of Construction by Subsectors and Industries (EC1223SG09). https://www.census.gov/econ/construction.html (Accessed January 2017).